technical analysis for dummies pdf

What is Technical Analysis?

Technical analysis is a method of evaluating securities by examining market activity data, such as past prices and volume. It uses charts to identify patterns and predict future price movements. Technical analysts do not measure a security’s intrinsic value.

Definition and Purpose

Technical analysis is essentially the art of forecasting future financial price movements by scrutinizing past price actions. It’s a method used to identify potential trading opportunities by visualizing market participants’ behavior through stock charts. This approach focuses on patterns and trends that emerge within these charts, helping traders make informed decisions about when to enter or exit positions. Unlike fundamental analysis, it doesn’t delve into the intrinsic value of an asset. Instead, it relies on the idea that history tends to repeat itself in the market, allowing traders to anticipate future price trends based on past patterns and data.

Core Principles of Technical Analysis

Technical analysis is based on three main premises⁚ market action discounts everything; prices move in trends; and history repeats itself. These form the foundation of this method.

Market Action Discounts Everything

This core principle suggests that all known factors, including economic, political, and psychological influences, are already reflected in the market price. Technical analysts believe that studying price and volume data alone is sufficient to understand market behavior. No matter what influences exist, the current price already represents the summation of all these forces. This principle also implies that all relevant information is already incorporated in the price.

Prices Move in Trends

This principle asserts that prices tend to move in trends, whether upward, downward, or sideways, rather than in random directions. Technical analysts focus on identifying these trends and capitalizing on their continuation. They believe that once a trend is established, it is more likely to persist than reverse. This makes trend identification a vital part of technical analysis. Traders use trendlines and other charting tools to discern these trends.

History Repeats Itself

This core principle suggests that market participants often react similarly to comparable situations. Because of this, past price patterns tend to recur. Chart patterns are a visual representation of this repetitive behavior. Technical analysts utilize this assumption to identify potential future price movements by analyzing past price behavior and patterns, assuming that history will likely repeat itself. By studying historical data, they can predict potential market reactions.

Key Tools in Technical Analysis

Technical analysis uses various tools, such as chart types (line, bar, candlestick), and trendlines. Support and resistance levels are also vital for identifying potential price movements. These are used to analyze markets.

Chart Types⁚ Line, Bar, and Candlestick

Line charts, the simplest form, connect closing prices over a period. Bar charts display the high, low, opening, and closing prices for each period. Candlestick charts, similar to bar charts, use a “body” to represent the open and close, and “wicks” to indicate the high and low. These chart types provide different visual perspectives on price movements, each useful in its own right to help understand market action.

Trendlines and Support/Resistance Levels

Trendlines are diagonal lines drawn on charts to show the direction of price movement. An uptrend is marked by higher lows, while a downtrend is characterized by lower highs. Support levels are price points where buying pressure is expected to prevent further declines. Conversely, resistance levels are price points where selling pressure is expected to halt upward price movement. Identifying these levels is crucial for traders seeking potential entry and exit points. These tools help visualize market trends and potential price reversals.

Technical Indicators

Technical indicators are mathematical calculations based on price and volume data. They provide insights into market trends, momentum, and volatility. These tools help traders analyze market behavior and make informed decisions.

Types of Indicators⁚ Trend, Momentum, Volume, Volatility

Technical analysis uses various indicators to understand market dynamics. Trend indicators, such as moving averages, help identify the direction of price movements. Momentum indicators, like RSI, measure the speed of price changes. Volume indicators, analyze trading activity to confirm trends. Volatility indicators, such as Bollinger Bands, assess the degree of price fluctuations. These tools provide a comprehensive view of market conditions and aid in making trading decisions.

Technical Analysis vs. Fundamental Analysis

Technical analysis focuses on price charts and market data, while fundamental analysis evaluates a company’s financial health, revenue, and industry trends. They differ in approach and timeframe for analysis.

Differences in Approach

Technical analysis primarily uses price and volume data from charts to identify patterns and trends, aiming to predict future price movements based on market behavior. It’s a short-term approach. In contrast, fundamental analysis assesses a company’s intrinsic value by examining financial statements, industry trends, and economic factors, making it a longer-term perspective. Technical traders focus on market psychology, while fundamental analysts evaluate economic health. Both seek market insights, but from different angles.

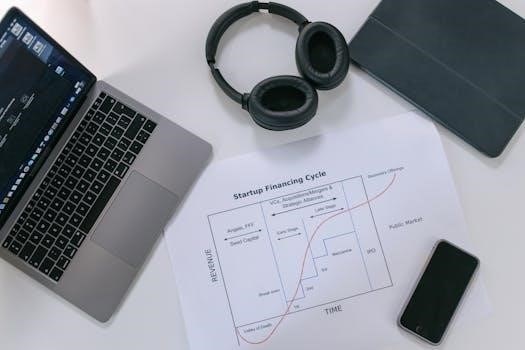

Dow Theory as a Form of Technical Analysis

Dow Theory, a form of technical analysis, is based on the stock market’s movements. The theory was derived from the writings of Charles H. Dow, a journalist and founder.

Basic Tenets of Dow Theory

The Dow Theory is built upon the idea that the stock market reflects all available information. It posits that market trends are a combination of three primary movements⁚ the primary trend, the secondary reaction, and the minor fluctuations. These trends are used to help forecast stock market direction. The theory emphasizes the importance of price and volume in confirming trends, suggesting that markets move in discernible patterns over time, providing a method for technical analysis.

Practical Applications of Technical Analysis

Technical analysis helps traders identify entry and exit points by analyzing price charts and patterns. It also aids in formulating effective trading strategies based on market trends and momentum.

Identifying Entry and Exit Points

Technical analysis is instrumental in pinpointing potential entry and exit points for trades. By examining charts, traders can identify areas of support and resistance, which indicate where prices may reverse. Chart patterns, like triangles or flags, also signal potential breakouts or breakdowns. Furthermore, technical indicators can confirm trends and momentum, helping traders make informed decisions about when to enter or exit a position, aiming to maximize profits and minimize losses through strategic timing.

Formulating Trading Strategies

Technical analysis provides the framework for building structured trading strategies. Traders use technical tools like trendlines, indicators, and chart patterns to devise rules for entering and exiting positions. These strategies can be tailored to different time frames and risk tolerances. By backtesting these strategies on historical data, traders can evaluate their effectiveness. Furthermore, technical analysis allows for the development of both trend-following and counter-trend strategies, enhancing the trader’s toolkit for various market conditions, ultimately enabling systematic approaches to trading.

Advanced Technical Analysis

Beyond basic concepts, advanced technical analysis delves into complex chart patterns and their interpretations. These patterns can provide insights into potential price movements, enabling more sophisticated trading strategies.

Chart Patterns and Their Interpretation

Chart patterns are formations on price charts that suggest potential future price movements. These patterns, such as triangles, flags, and head and shoulders, are identified by technical analysts to predict market direction. Understanding these patterns requires recognizing their shapes and the context in which they occur. Correct interpretation of chart patterns is a crucial aspect of advanced technical analysis, allowing traders to anticipate market shifts and formulate effective trading plans. These patterns reflect market psychology, revealing buying and selling pressures.

Learning Technical Analysis

To begin learning technical analysis, utilize resources such as books, online courses, and educational materials. These resources will help you understand the basics of charting and market indicators, and provide a solid foundation.

Resources⁚ Books, Courses, and Online Materials

Numerous resources are available for learning technical analysis, catering to various learning styles. Books offer in-depth knowledge, while online courses provide structured learning paths. Many websites offer free educational articles, videos, and webinars. It is important to explore various resources to find the ones that align best with your learning preferences and goals. Remember to start with the basics and gradually work your way up to advanced concepts and strategies.

Leave a Reply